osceola county property tax payment

As part of our commitment to provide citizens with efficient convenient service the Village has partnered with Official Payment Corporation to offer payment of the first half of your real estate taxes over the internet or by telephone by calling 1-800-272. Taxes become delinquent on April 1st each year at which time a 15 percent fee per month is added to the bill.

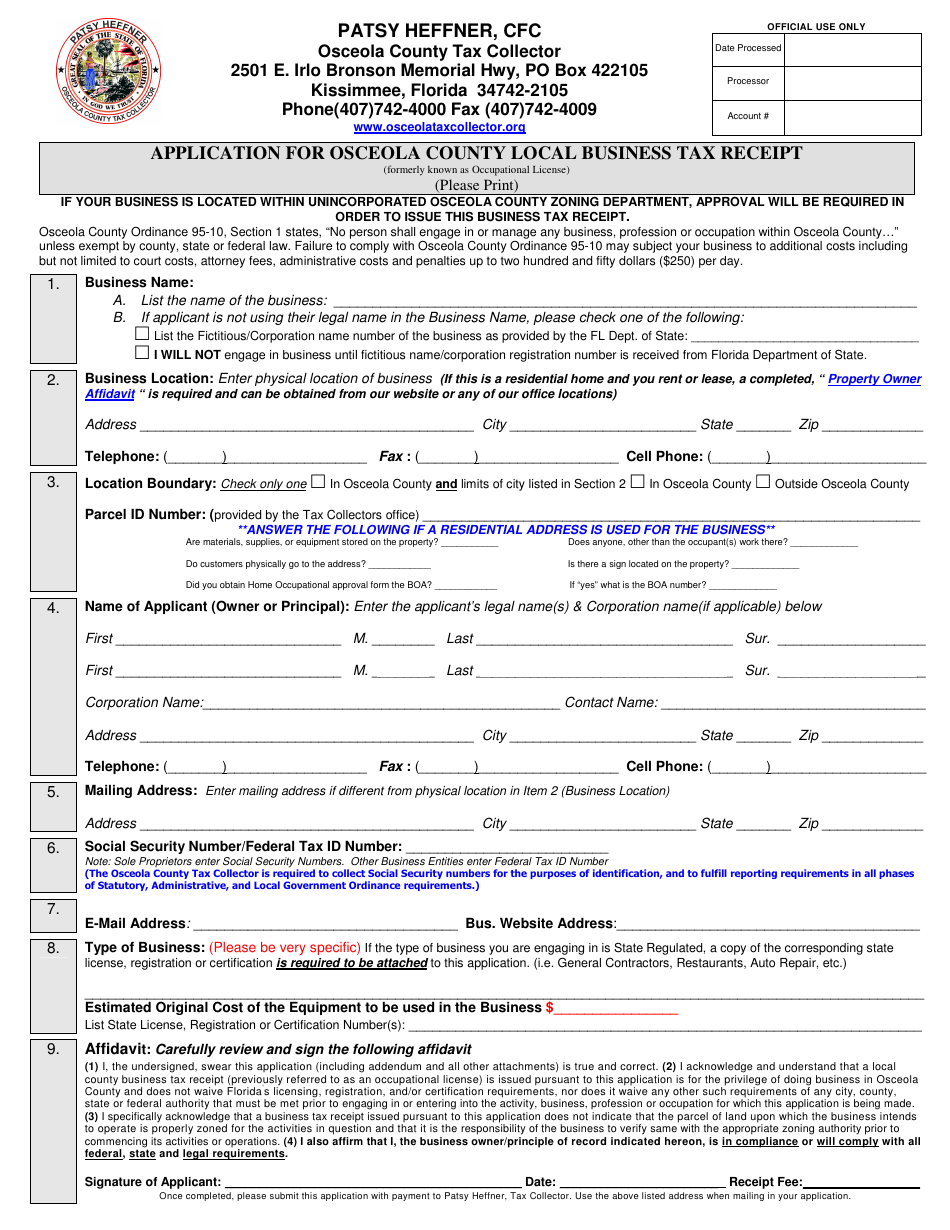

Osceola County Forms Form Ead Faveni Edu Br

The Amount Payable Online represents all taxes that are payable online for each parcel listed in either the first September or second March payment period.

. PAY TAXES RENEW YOUR TAGS AND MUCH MORE. You can talk to a live agent to pay with eCheck credit or debit card. This service allows you to search for a specific record within the Delinquent Tax database to make a payment on.

Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143 counties in order of median property taxes. Osceola County Property Appraiser. Property taxes have always been local governments very own area as a funding source.

Search all services we offer. Property owners are required to pay property taxes on an annual basis to the County Tax Collector. The state depends on property tax income a lot.

Osceola County collects on average 095 of a propertys assessed fair market value as property tax. Please note there is a processing fee to use this service which is a minimum of 150 or 3 of your total bill. The number and significance of these public services relying upon real estate taxpayers cant be overestimated.

A tax certificate when purchased becomes an enforceable first lien against the real estate. Dont wait in line. Pay Property Taxes Online in Osceola County Michigan using this service.

If the owner fails to pay hisher taxes a tax certificate will be sold by the Tax Collector. Osceola County Tax Collector - Office of Bruce Vickers Serving our. What is the due date for paying property taxes in Osceola county.

If you are contemplating taking up residence there or only planning to invest in Osceola County property youll learn whether the countys property tax laws are helpful for. 2505 E Irlo Bronson Memorial Highway. All taxes become delinquent to the County Treasurer on March 1 with additional penalties and interest.

407-742-4009 Local BusinessTourist Tax BRUCE VICKERS CFC CFBTO ELC. Osceola County Courthouse 300 7th Street Sibley Iowa 51249 712 754-2241. Summer taxes are due by September 14 without interest.

When are taxes due. Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523. OSCEOLA COUNTY TAX COLLECTOR.

Welcome to the Delinquent Tax Online Payment Service. Township residents have the option of making partial payments on the taxes due for their property during the tax collection season. Real estate taxes become delinquent each year on April 1st.

Payment of first half of real estate taxes is payable to the Village of Osceola by January 31st of each year. OSCEOLA COUNTY TAX COLLECTOR. To Pay Taxes Online.

This deferment allows you time to pay your winter taxes between March 1 - April 30 without penalty or interest in anticipation of receiving a homestead property tax refund. Property taxes are due on September 1. Taxpayers can call Personal Teller at 877-495-2729.

Your account number is your parcel number that begins with 67. The Tax Collectors Office provides the following services. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email.

Click on any of the following links to make a payment. If you dont pay by the due date you will be charged a penalty and interest. 407-742-3995 Driver License Tag FAX.

Partial payments for Summer tax bills can be made between July 1st and February 28th and partial payments for Winter tax bills can be made between December 1st and February 28th. Property Appraisers Office 2505 E Irlo Bronson Memorial Hwy Kissimmee FL 34744. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart.

CHECK WHICH LINK YOU ARE CLICKING ON TO ENSURE YOU ARE PAYING WITH THE CORRECT SYSTEM. Osceola Tax Collector Website. BSA Software provides BSA Online as a way for municipalities to display.

Preview your current tax bill. Full or partial payments of current and delinquent taxes will be accepted at any. Oceola Township current property taxes are able to be accessed and paid online using debitcredit cards.

To begin please enter the appropriate information in one of the searches below. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. If the estimated tax is greater than 10000 tangible personal property taxes may be paid quarterly.

Summer 2022 Property Tax Information. OSCEOLA COUNTY TAX COLLECTOR. Tax Deed Sale Process.

Winter taxes are due by February 14 without penalty. All major debit and credit cards except American Express can be used to make a payment. Together with Osceola County they count on real estate tax payments to perform their public services.

Taxpayers may also make property tax payments online at the BSA Online website. With this resource you will learn helpful knowledge about Osceola County property taxes and get a better understanding of things to consider when it is time to pay. 407-742-4037 Property Taxes FAX.

Make an appointment online and save valuable time. Visit their website for more information. Irlo Bronson Memorial Hwy.

Irlo Bronson Memorial Hwy. Property taxes may be paid in semi-annual installments due September and March. Pay your tax or water bill online.

Irlo Bronson Memorial Hwy. In order to use this service you will need to click on the link below and follow the instructions to create a user login and password.

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Property Tax Search Taxsys Osceola County Tax Collector

Osceola County Property Appraiser 2505 E Irlo Bronson Memorial Hwy Kissimmee Fl 34744 Usa

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf Facebook

Osceola County Property Appraiser 2505 E Irlo Bronson Memorial Hwy Kissimmee Fl 34744 Usa

Osceola County Fl Property Tax Search And Records Propertyshark

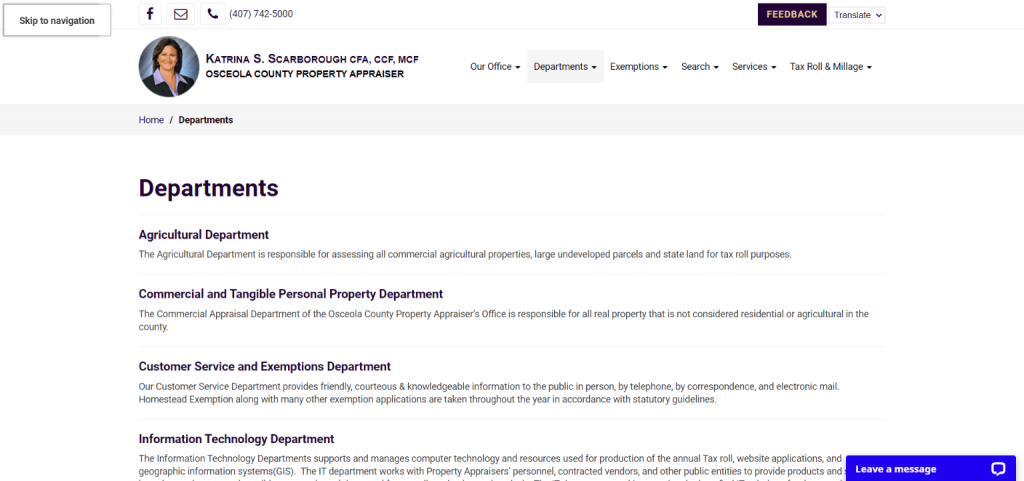

Osceola County Property Appraiser How To Check Your Property S Value

Property Search Osceola County Property Appraiser

Osceola County Property Appraiser How To Check Your Property S Value

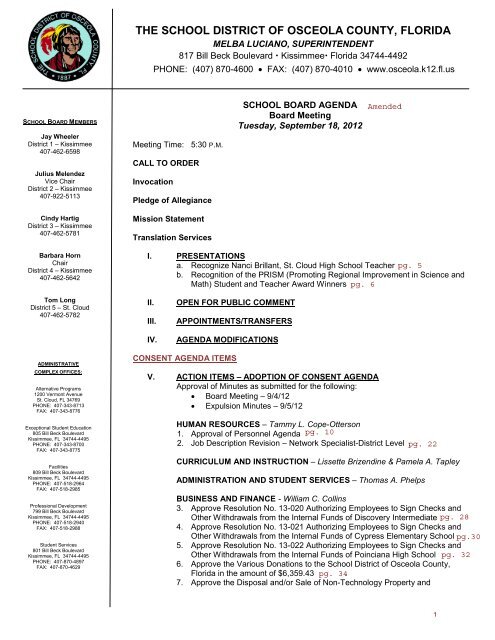

Curriculum Amp Instruction Consent Agenda Osceola County School